Inexpensive Pet Insurance Program for every single Family Pet Parent

Navigating the landscape of inexpensive pet insurance policy strategies is critical for pet dog parents aiming to guard their fuzzy buddies while managing prices. With a range of options readily available, from fundamental accident-only coverage to even more detailed plans tailored to private demands, recognizing the subtleties of each can make a significant distinction in economic readiness. Variables such as costs, deductibles, and service provider credibility likewise play a crucial role in decision-making. As we explore these factors to consider, it ends up being clear that educated choices are crucial for guaranteeing both pet wellness and financial security. What should be the next action in this vital trip?

Understanding Animal Insurance Policy Essentials

Understanding the basics of family pet insurance policy is important for any type of family pet proprietor looking for to safeguard their furry buddies versus unanticipated clinical expenses. Pet insurance coverage is created to relieve the financial burden related to veterinary care, especially in emergency situations or for persistent problems. It runs in a similar way to medical insurance for humans, with policyholders paying a monthly premium in exchange for coverage on various medical services.

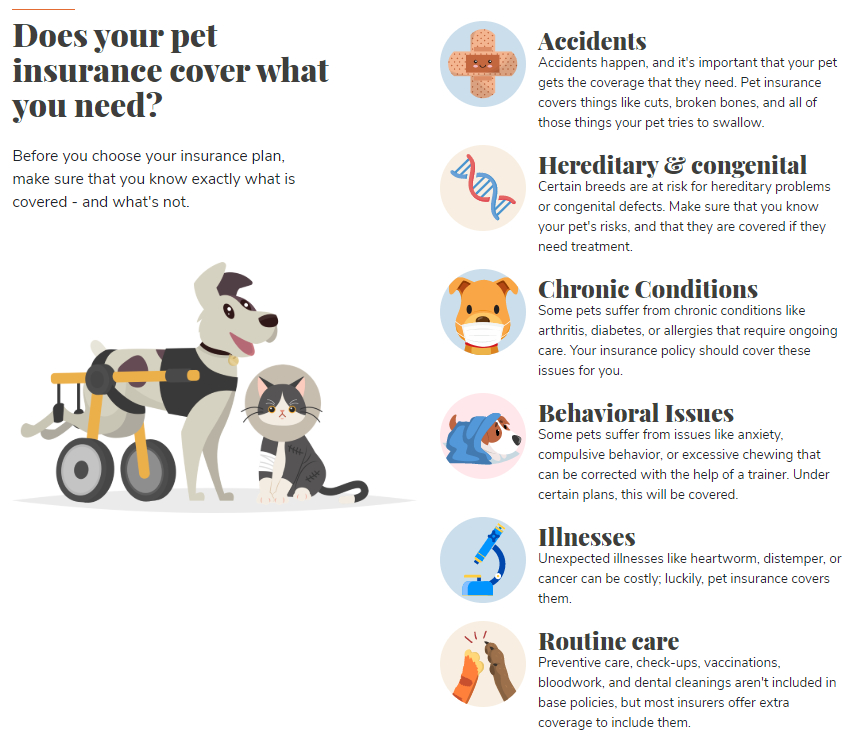

Many family pet insurance coverage cover a range of solutions, including crashes, ailments, and sometimes preventive care. It is vital for family pet proprietors to be aware of policy exemptions, waiting durations, and protection limits that might use. As an example, pre-existing conditions are generally not covered, which can significantly influence the total value of a plan. The compensation process usually needs pet dog owners to pay the veterinarian upfront and then send claims for repayment, which can vary based on the copyright's procedures.

Sorts Of Animal Insurance Coverage Program

Animal insurance coverage strategies can be categorized into a number of distinctive types, each developed to satisfy the differing needs of animal proprietors. One of the most usual types include accident-only plans, which cover injuries arising from crashes but exclude diseases. These strategies are usually more budget friendly and suitable for pet dog proprietors seeking basic security.

Detailed strategies, on the various other hand, deal wider insurance coverage by consisting of both ailments and crashes. This kind of strategy is ideal for pet owners that desire considerable defense for their pets, covering a wide array of clinical concerns, from small conditions to chronic illness.

Another option is a health or preventative treatment plan, which focuses on routine vet solutions such as inoculations, dental cleanings, and yearly exams. While these strategies usually do not cover illnesses or emergency situations, they urge positive health measures.

Last but not least, there are personalized plans, allowing pet dog proprietors to tailor their insurance coverage based on their pet dog's certain needs. This flexibility can aid handle costs while making certain appropriate coverage. Recognizing these kinds of pet insurance policy plans can encourage family pet owners to make enlightened decisions that line up with their economic and treatment priorities.

Variables Impacting Costs Expenses

The price of pet insurance coverage costs can differ dramatically based on several essential aspects. The pet dog's health history plays an important duty; pre-existing problems can lead to exemptions or raised rates.

Another significant element is the level of protection picked. Comprehensive intends that consist of health treatment, preventative therapies, and greater reimbursement percentages generally come more information with higher premiums compared to basic plans. Additionally, the annual deductible chosen by the animal owner can influence costs; reduced deductibles typically result here are the findings in greater month-to-month costs.

Animal moms and dads in metropolitan areas might deal with greater premiums than those in country settings. Recognizing these aspects can help family pet owners make educated decisions when choosing an insurance strategy that fits their budget and their family pet's needs.

Contrasting Leading Animal Insurance Providers

Many pet insurance coverage carriers offer a range of strategies, making it essential for animal proprietors to contrast their alternatives thoroughly. Principal in the pet dog insurance market include Healthy Paws, Embrace, and Petplan, each providing one-of-a-kind attributes that satisfy different needs.

Its emphasis on client service and fast cases handling has garnered favorable responses from family pet owners. Conversely, Embrace offers personalized strategies, enabling pet proprietors to change deductibles and reimbursement levels, which can lead to even more budget-friendly premiums.

When contrasting service providers, pet dog owners need to consider aspects such as coverage limitations, exemptions, and the claims procedure. By extensively evaluating these components, pet parents can pick a plan that finest fits their economic and medical demands for their furry companions.

Tips for Picking the Right Strategy

How can animal owners navigate the myriad of choices offered when picking the appropriate insurance plan for their furry companions? To start, evaluate your animal's certain needs based on age, health, and breed background. Older family pets or those with pre-existing conditions might call This Site for more extensive insurance coverage, while younger animals could take advantage of basic strategies.

Next, compare the coverage options. Look for strategies that consist of crucial solutions like regular examinations, vaccinations, and emergency treatment. Be conscious of exclusions and waiting periods. Understanding what is not covered is as critical as recognizing what is.

Checking out customer evaluations and ratings can supply insight into the provider's dependability and customer support. Last but not least, think about the life time limits on insurance claims, as some strategies cap payouts yearly or per problem (Insurance).

Verdict

To conclude, cost effective pet insurance coverage strategies are essential for managing unanticipated vet expenditures while ensuring ideal treatment for pet dogs. A comprehensive understanding of the different kinds of insurance coverage, costs determinants, and options offered from leading suppliers substantially enhances the decision-making process for animal parents. By thoroughly comparing plans and thinking about private demands, pet dog proprietors can safeguard reliable defense without stressing their funds, therefore advertising the well-being of their cherished buddies.

Navigating the landscape of budget-friendly family pet insurance coverage plans is important for family pet parents aiming to safeguard their furry friends while managing prices.Pet dog insurance coverage plans can be categorized into numerous distinctive types, each developed to meet the differing demands of family pet owners. Understanding these kinds of pet dog insurance coverage plans can empower pet dog proprietors to make informed choices that straighten with their monetary and care priorities.

Understanding these variables can assist animal proprietors make notified decisions when picking an insurance coverage plan that fits their spending plan and their family pet's needs.

In verdict, cost effective family pet insurance strategies are important for taking care of unanticipated veterinary costs while ensuring optimum care for pet dogs.